AAP FACTCHECK – A bank’s move to phase out cash and cheque transactions has sparked social media claims that customers of “Australia’s biggest bank” will “lose everything” if they refuse to accept a central bank digital currency (CBDC).

The claims are false. Macquarie Bank – which is not Australia’s biggest bank – is phasing out its cash and cheque services this year, but the move is unrelated to a CBDC, which doesn’t exist in Australia.

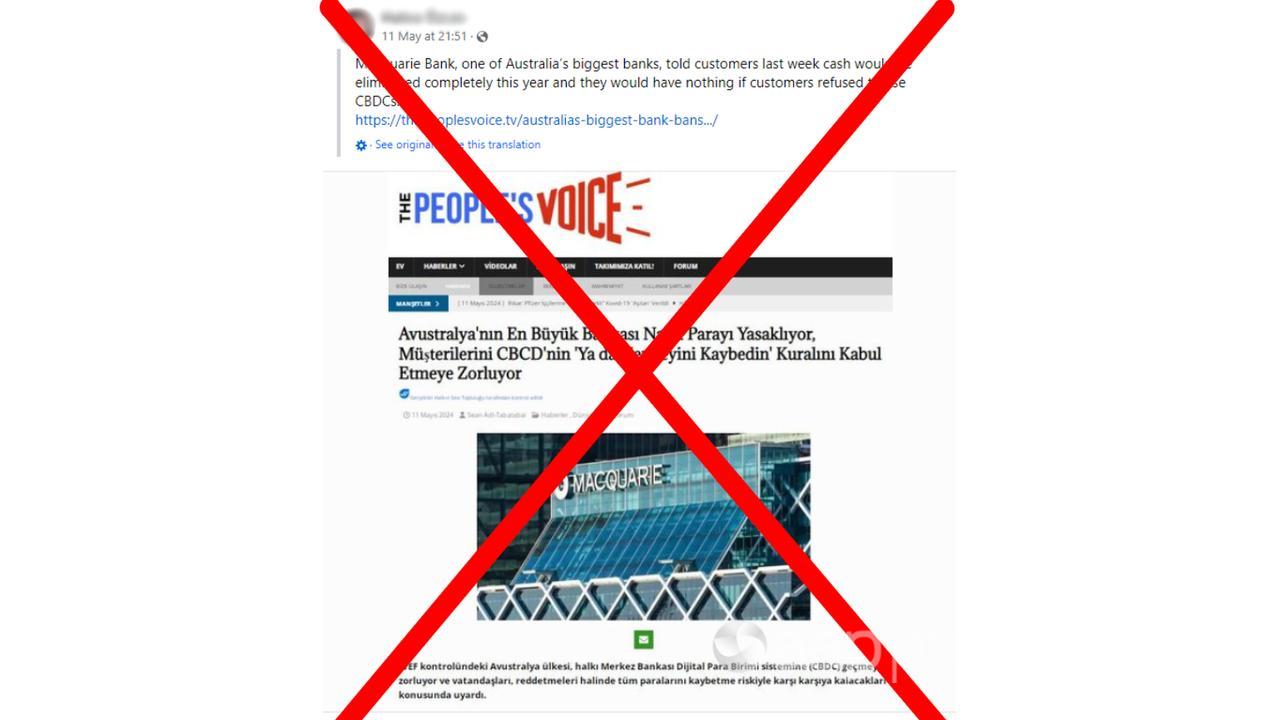

The claim is made in a Facebook post captioned: “Macquarie Bank, one of Australia’s biggest banks, told customers last week cash would be eliminated completely this year and they would have nothing if customers refused to use CBDCs.”

Another post claims Australia is forcing the public to switch to a CBDC system and has warned customers that if they “refuse to use CBDC’s [sic] they will own nothing”.

Both posts link to an article on The People’s Voice, a US website known for publishing misinformation.

The article is headlined: “Australia’s Biggest Bank Bans Cash, Forces Customers To Adopt CBCDs (sic) ‘Or Lose Everything’.”

The body of the article quotes Macquarie Bank’s own published information about the move: “We’re phasing out our cash and cheque services for all products. To prepare for this change, you’ll need to start transacting digitally.”

Macquarie’s changes were announced in September 2023.

Some media reported that the move means customers will no longer be able to process cheques and cash deposits or withdrawals from within branches, while others reported it as “going cashless”.

The bank says “going cashless” is inaccurate, as Macquarie customers can still withdraw cash from ATMs.

“As a digital bank, Macquarie doesn’t operate a traditional branch network and this update relates to over-the-counter cash and cheque services at three Macquarie locations,” the bank’s statement says.

Finance academics tell AAP FactCheck that Macquarie’s move is unrelated to CBDC, contrary to the posts.

The Reserve Bank of Australia (RBA) describes a CBDC as a “new digital form of money issued by the Reserve Bank“.

Although the bank is actively researching it as a “complement to existing forms of money”, it doesn’t yet exist in Australia.

Associate Professor of Finance at RMIT University in Melbourne Dr Angel Zhong says Macquarie’s move is different from a CBDC.

She explains that the RBA currently issues two forms of money in Australia: physical currency (banknotes and coins) and digital currency (balances within accounts maintained by commercial banks and select financial entities at the RBA).

Macquarie’s move only means it is no longer dealing in the first type, Dr Zhong says, adding: “CBDC is different from digital currency.”

Dr Chris Vasantkumar, an expert in the “anthropology of money” at Macquarie University, says there isn’t a CBDC in Australia yet, so “Macquarie Bank’s customers can’t be forced to use one”.

He also says Macquarie’s move won’t take money from its customers: “What is being lost is not people’s money but particular ways of accessing.”

Dr Zhong says the claim that Macquarie Bank customers will lose everything if they don’t accept CBDC is false.

“Macquarie has listed all options in its statement,” she says.

“There is no mention of CBDC at all.”

UNSW Sydney Scientia Professor Ross Buckley says the claim that Macquarie is Australia’s biggest bank is also false, as Commonwealth Bank of Australia is the nation’s largest.

The Verdict

The claim that Australia’s biggest bank has told customers to adopt central bank digital currency (CBDC) or “lose everything” is false.

Macquarie is not Australia’s biggest bank, and its move to phase out cash transactions and the use of cheques is not related to a CBDC, which is some years away.

Customers will not lose any money in the move.

False – The claim is inaccurate.

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Twitter and Instagram.

All information, text and images included on the AAP Websites is for personal use only and may not be re-written, copied, re-sold or re-distributed, framed, linked, shared onto social media or otherwise used whether for compensation of any kind or not, unless you have the prior written permission of AAP. For more information, please refer to our standard terms and conditions.