AAP FACTCHECK – It’s illegal to pay tax if the Australian government is using the money to commit war crimes and genocide, social media posts have claimed.

This is false. There’s nothing in Australian law that says you don’t have to pay tax if the government is committing war crimes or genocide, or that it’s a crime if you do pay tax which is used for these reasons.

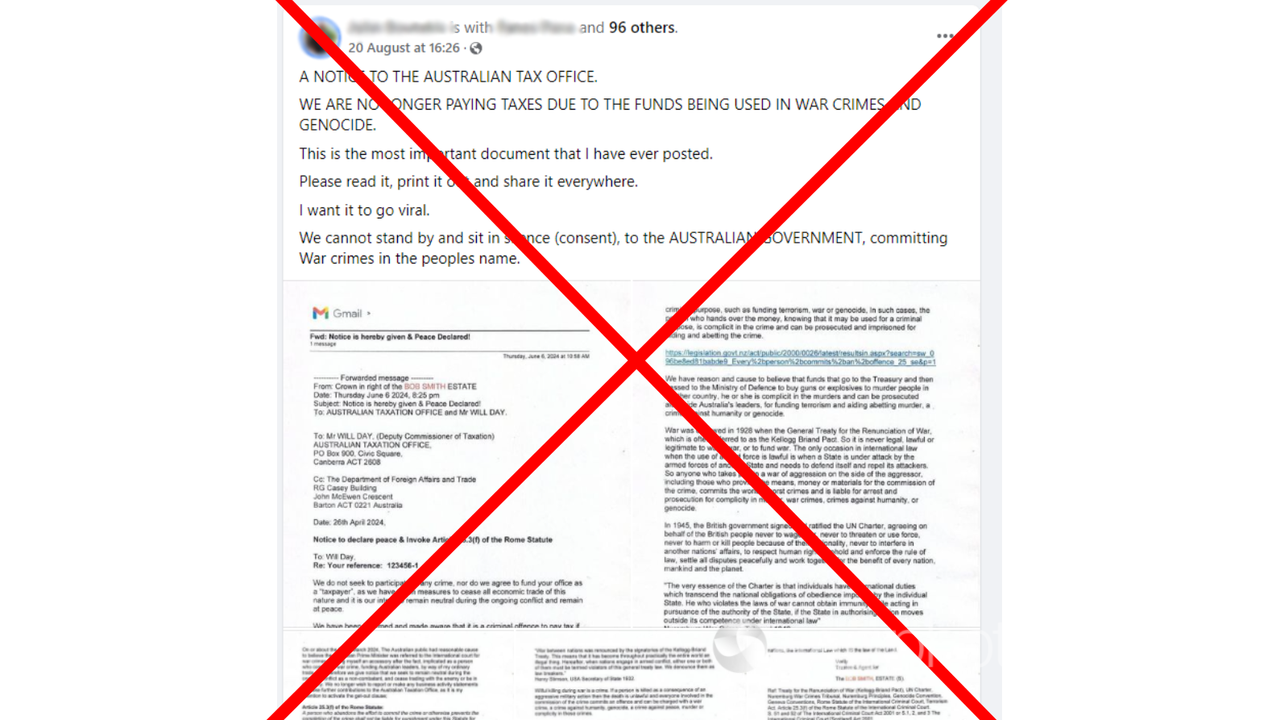

The claim appears in multiple Facebook posts as “A NOTICE TO THE AUSTRALIAN TAX OFFICE” (ATO).

“WE ARE NO LONGER PAYING TAXES DUE TO THE FUNDS BEING USED IN WAR CRIMES AND GENOCIDE,” the posts read.

Attached are images of a five-page-long email sent to the deputy commissioner of the ATO, dated April 26, 2024.

“We have been informed and made aware that it is a criminal offence to pay tax if any of it is used to fund genocide, murder, or any criminal activity according to the 1945 UN Charter, Terrorism Act 2000 & Nuremberg Code,” the email reads.

“If that government uses the funds raised by taxation to wage illegal war or to commit genocide, crimes against humanity or war crimes, then a taxpayer’s normal duty to pay tax is reversed and becomes a duty to refuse to pay tax.”

The email also asserts that the law says taxpayers and tax collectors can be arrested, tried, and punished as war criminals if they pay tax that’s used to fund war crimes.

AAP FactCheck spoke to several experts who said the claim is incorrect.

“The legal instruments cited in the email have no effect in Australian law and in any event do not provide that people who pay or collect tax that is used to fund genocide, murder or criminal activity shall be arrested, tried and punished as war criminals,” Associate Professor Harry Hobbs, from the University of Technology Sydney’s law faculty, said.

“The UN Charter is an international agreement that binds member states not individuals, the Terrorism Act 2000 is UK legislation and does not apply in Australia, the Nuremberg Code is also not law and deals with ethics in human experimentation.

“None of these documents even mentions the word tax.”

He added that there’s no law in any country that he’s aware of that views an ordinary citizen who pays tax to their government as an accessory to war crimes, or that lawfully allows someone to refuse to pay tax on this basis.

Dr Carrie McDougall, a senior lecturer at the University of Melbourne Law School, also said the posts’ principal claims are false.

“The post reflects a complete misunderstanding of international criminal law, the prohibition of the use of force, and applicable rules of international humanitarian law,” she said.

Professor Emily Crawford, of the University of Sydney Law School, added that the posts draw on laws which aren’t applicable in Australia.

This includes a Scottish statute, as well as the “Rule of 1756”, a British policy adopted during the Seven Years War that never reached a legal status that would bind Australia, let alone Australian citizens.

The Verdict

False – The claim is inaccurate.

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Twitter and Instagram.

All information, text and images included on the AAP Websites is for personal use only and may not be re-written, copied, re-sold or re-distributed, framed, linked, shared onto social media or otherwise used whether for compensation of any kind or not, unless you have the prior written permission of AAP. For more information, please refer to our standard terms and conditions.