Victoria has become the first Australian jurisdiction to legislate a levy on short-stay bookings with platforms like Airbnb and Stayz.

The Australian-first statewide short-stay levy will begin on January 1, 2025, after the reforms passed the state parliament’s upper house on Thursday.

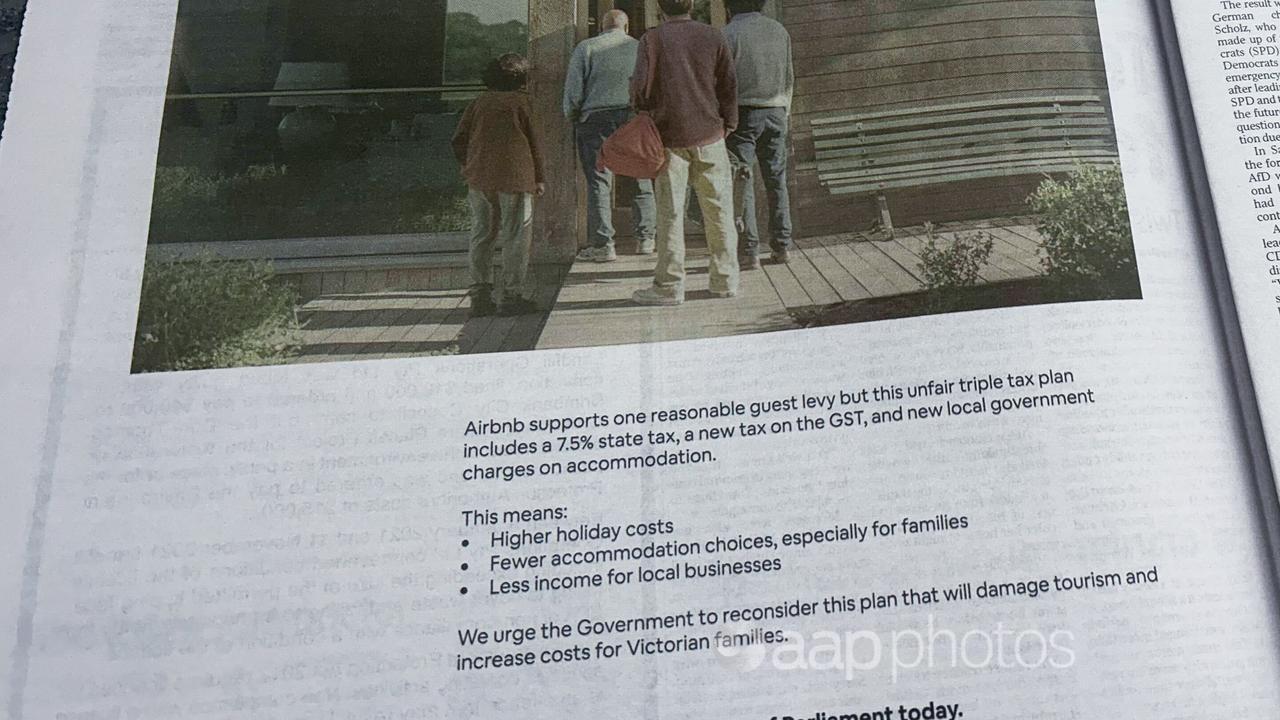

Under the controversial reforms, users will be slugged an extra 7.5 per cent on Airbnb and Stayz bookings across Victoria.

Those leasing out part or all of their principal place of residence for short stays will be exempt, as are hotels, motels and caravan parks.

Owner corporations will be able to ban short-stays in their buildings with a 75 per cent vote, and the charge is restricted to stays of fewer than 28 days.

Amendments to the bill to extend exemptions to vulnerable groups including disabled people and those fleeing family violence were voted down.

The final vote was 21 to 15 in favour.

Attorney-General Jaclyn Symes said the government opposed the amendments because they would be too difficult to administer.

Shadow Treasurer Brad Rowswell rubbished that argument.

“We shouldn’t be charging taxes in this state to vulnerable Victorians because the government and State Revenue Office can’t figure out how they’re going to administer carve-outs,” he said.

Mr Rowswell denied he had a conflict of interest as the owner of a short stay-listed property at Halls Gap in the state’s Grampians region.

“I haven’t hidden any of that, in fact, it’s all been declared,” he said.

“This tax isn’t being charged to the owners of short-stay accommodation, it’s being charged to Victorians who choose to use it.”

The bill’s passage through the upper house was all but assured in late August when Labor announced local councils would retain powers to set regulations for short-stay providers to win the Greens’ support.

It means councils will still be able to apply their own charges, require a permit or cap the number of nights a property can be rented as a short-stay accommodation.

When the levy was unveiled in the Victorian government’s housing statement in 2023, then-premier Daniel Andrews said it would create one framework and effectively “extinguish” local governments’ ability to charge fees.

The levy is expected to raise about $60 million a year for social and affordable housing.

The Victorian opposition has promised to repeal it if it wins the 2026 state election.