The Statement

A Facebook post claims that Australia's treasurer, Josh Frydenberg, enjoys a far more generous superannuation scheme than the general public while purportedly trying to defeat plans that would deliver higher benefits for all.

The November 24 post includes a screenshot of a tweet which includes two photos of Mr Frydenberg below its text.

The tweet reads: "This is Josh. He gets 15.4% super & he can access it as soon as he leaves parliament. You get 9.5%. You have to wait until 67. There is a super guarantee which will raise your super to 12%. Josh wants to stop this. That's what his sweaty rants are about. Because f*** you."

The post is captioned: "And the unashamed Bias will continue if Workers keep voting these arseholes in!"

At the time of publication, the post had been shared more than 340 times, attracting more than 380 reactions and 65 comments. The original tweet has been retweeted more than 900 times, receiving more than 3000 likes, while similar screenshots of the tweet have also been shared elsewhere on Facebook.

The Analysis

While Australia's federal MPs and senators benefit from superannuation perks above those available to the wider public, the option to cash out upon leaving the parliamentary benches is only available to a handful of long-standing representatives.

Only those who have been in parliament since before the 2001 election are eligible to automatically access large lump-sum payments once they exit their elected roles.

In Australia, workers are entitled to a minimum superannuation contribution from employers of 9.5 per cent of their earnings. This is due to rise to 12 per cent by 2025, with the next increase, to 10 per cent, scheduled for July 1, 2021.

However, media reports have suggested Mr Frydenberg may move to delay the scheduled increases following the release of an independent review into retirement income on November 20 which found lifting the rate would result in lower wages and affect living standards for workers.

Prime Minister Scott Morrison promised during the 2019 election campaign to deliver the increases but has since said the government would "carefully consider" the change in the context of the COVID-19-induced economic downturn.

Under the Parliamentary Superannuation Act 2004, federal parliamentarians already receive a 15.4 per cent superannuation contribution based on their core allowances and any additional salaries they receive as office-holders.

The Act replaced an earlier scheme, under which those elected before the 2004 poll were entitled to a "retiring allowance" - a fixed pension for life - if they had served for a minimum of eight years.

The allowance ranges from 50 per cent of parliamentarians' standard pay rates at retirement for those who had served eight years up to 75 per cent for those who had served 18 years of more. There are additional benefits for those who served as ministers or other office holders.

A prime minister retiring today could be entitled to a lifelong pension of up to $328,162 under the old scheme, a Department of Finance spokesman confirmed to AAP FactCheck via email.

However, in order to qualify for the maximum amount they would need to have held higher parliamentary offices for several years in addition to first being elected before 2004.

A newly retired parliamentarian on the base salary but covered under the earlier scheme would be entitled to a minimum pension of $125,362.

Parliamentarians elected before the 2001 poll could receive their retiring allowance from the time they left parliament - and could opt to receive 50 per cent of the allowance as a lump sum.

However, those elected in 2001 or before 2004 would only receive the allowance or lump sum payment once they reached the "preservation age". This ranges from 55 to 60 depending on a person's year of birth.

All parliamentarians who first took their seats at the 2004 election or later fall under the new superannuation scheme, which remains in place.

A spokesman for the Department of Finance told AAP FactCheck via email that access to lump-sum superannuation benefits for parliamentarians was now "subject to the same conditions that apply to the broader community".

"Access to superannuation benefits is generally restricted to members who have reached preservation age on retirement," he said.

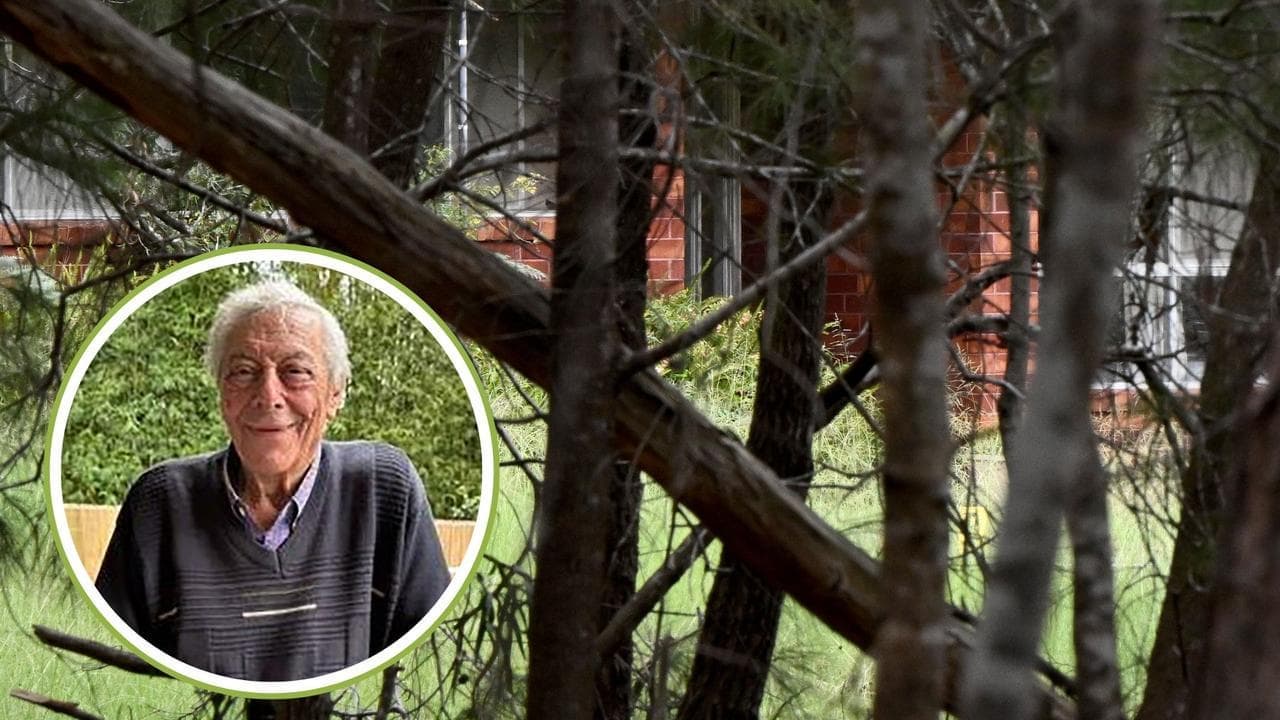

Mr Frydenberg was first elected to the House of Representatives in 2010, rendering him ineligible for the former pension scheme. The Treasurer would also need to wait until at least his preservation age of 60 to access any lump-sum benefits. He turned 49 in July.

Other senior members of the government, such as Prime Minister Scott Morrison and Deputy Prime Minister Michael McCormack, would also be ineligible for the replaced pension scheme. Mr Morrison was first elected in 2007 and Mr McCormack in 2010.

Nevertheless, several elected representatives remain eligible for life-long pensions. For example, the longest-serving member of the current House of Representatives, Kevin Andrews, was first elected in 1991, entitling him to the previous benefits.

While the age at which Australians can receive the state pension is currently 66, this is due to gradually increase to 67 by July 2023. However, this differs from the age at which the public can access their superannuation benefits.

These funds can be accessed either at the age of 65, regardless of retirement status, or when people reach their preservation age if they retire early.

The Verdict

While the post is correct in stating that Treasurer Josh Frydenberg receives superannuation contributions of 15.4 per cent - compared to a minimum of 9.5 per cent for the general public - he can't access the funds as soon as he leaves parliament as claimed. Only those elected before the 2001 poll are entitled to lump sums when they exit parliament.

The post also incorrectly states that the public can't access their superannuation until the age of 67. This age limit will apply to the pension from 2023, however the public can automatically access their superannuation at 65 or if they retire early after reaching a preservation age of between 55 and 60. These rules also apply to Mr Frydenberg.

Partly False – Content that has some factual inaccuracies.

AAP FactCheck is an accredited member of the International Fact-Checking Network. If you would like to support our independent, fact-based journalism, you can make a contribution to AAP here.