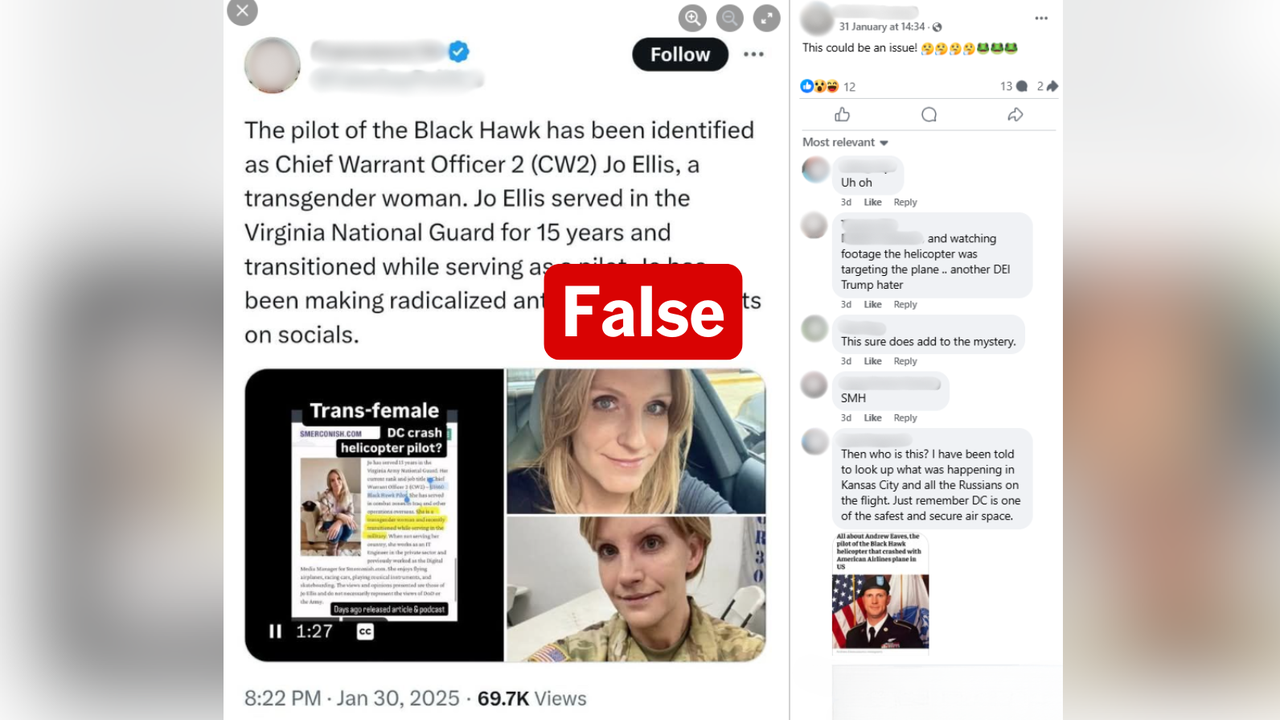

WHAT WAS CLAIMED

Labor's Bill Shorten set up Robodebt.

OUR VERDICT

Misleading. While Labor's data matching scheme was a precursor, experts and a 2021 Ombudsman report note significant differences between the two.

Prime Minister Anthony Albanese has ordered a royal commission into the former coalition government's 'Robodebt' program.

But coalition leader Peter Dutton has claimed it was actually Labor's Bill Shorten who set it up.

The claim is misleading. Labor introduced and later developed data matching techniques to identify potential overpayment of welfare benefits. But experts and a 2021 Ombudsman report note significant differences between this and the coalition's 2016 Online Compliance Intervention (OCI) scheme, which would become known as Robodebt.

In particular, Robodebt increased automation of the debt collection process and used an income averaging calculation.

Mr Dutton made the claim during a media interview on August 25.

Asked for his reaction to Mr Albanese's royal commission announcement, he said: "Well, as you know, the data matching started under Labor when Minister Shorten was in that job, when Minister Plibersek was in that area. They set up the data matching that led to the collection of the alleged overpayments … If this is a legitimate look at the Robodebt situation, look at the start of it, it started under a Labor government. It started under Bill Shorten."

He added: "Bill Shorten should be the first witness at the inquiry because he set Robodebt up."

Launched in July 2016, the OCI program was intended to "enhance the integrity and compliance" of welfare payments through improved data matching processes that identified supposed overpayments and increased debt recovery.

The Commonwealth government has used data matching techniques since the early 1990s to identify welfare overpayments (page 3). However, Robodebt's automated processes reduced human oversight of alleged discrepancies and shifted the onus of proof onto affected individuals.

As a result of the automation, the number of 'compliance interventions' went from 20,000 a year to up to 20,000 every week (page 18). Almost half a million people received letters telling them they owed the government money.

However, many of the debt notices were wrong. Many alleged overpayments were calculated using a formula that averaged earnings over the relevant year so did not account for fluctuations in income.

Some found it too difficult or too stressful to challenge the purported debt while others paid up because they assumed the calculations were accurate (page 4).

In November 2019, the Federal Court ruled Robodebt's debt collection processes were unlawful and in May 2020, the program was scrapped ahead of a bigger class action lawsuit.

A spokesman for Mr Dutton told AAP FactCheck that the claim that "the Robodebt situation" began under Labor referred to Bill Shorten and Tanya Plibersek being "the designers" of Centrelink's automatic data matching policy.

The spokesman pointed to a government media release from 2011 - when Ms Plibersek was human services minister and Mr Shorten was assistant treasurer - that outlined "a new data matching initiative between Centrelink and the Australian Taxation Office" that was expected "to claw back millions of dollars from welfare recipients who have debts with the Australian Government".

But experts told AAP FactCheck the program launched by the coalition in 2016 was materially different from what had come before.

Professor Peter Whiteford, from ANU's Crawford School of Public Policy, said while an expansion of data-matching was announced by Labor in 2011, "it is not clear to me that this change can be equated to what happened under Robodebt".

"The essence of the way that Robodebt was unlawful was that it reversed the onus of proof, in that it required people who had been identified with discrepancies between ATO and Centrelink data to provide the evidence that they had not been overpaid," Prof Whiteford said in an email.

"Second, when they (welfare recipients) 'failed to engage' they (Centrelink) averaged the annual data reported to the ATO."

Prof Whiteford said there was also "a major difference between the scale of the 2011 change and Robodebt after 2015", in terms of the number of debt notices and the total value of those purported debts.

According to the 2011 media release, Labor estimated its enhanced data matching would recover $71 million over four years. Robodebt was expected to save $1.7 billion over five years, Prof Whiteford said.

Prof Whiteford's analysis echoed comments made by Emeritus Professor Richard Mulgan, also from the Crawford School of Public Policy.

Writing in the Sydney Morning Herald in 2017, Prof Mulgan said: "In 2011, the Gillard Labor government...introduced an automated system of cross-matching data from the two agencies. As a result, Centrelink staff were able to identify overpayments more efficiently. The amount of recovered government debt climbed significantly.

"The new (coalition government) policy builds on Labor's scheme but relies solely on an algorithm to identify possible double-dippers and to send them a letter without allowing staff any discretion over whom should be approached. It casts the net widely, consciously targeting many who will turn out to have done nothing wrong but allowing them the opportunity to prove their innocence by providing relevant documents."

Dr Darren O'Donovan, an administrative law academic at La Trobe Law School, told AAP FactCheck that the coalition's Robodebt program marked a step-change from Labor's previous processes.

"Prior to 2015, the cases were risk profiled - only the highest discrepancies would move forward," he said in an email.

"Crucially employers and the people themselves would be contacted for further evidence … The policy did say an annual figure could be used as a last resort but that was accompanied by a warning about the legality of doing so.

"In April 2015, the government agreed to switch off these existing safeguards … The data match in its raw form would be piped in, and staff would divide the ATO's annual payment summary income figure by 26 using a tool … Anyone who has ever worked casually, had deductions, volatile hours or loading understands why averaging is unlawfully crude. To understand what a person earns in a fortnight, you can't just assume they work equally across the year."

A 2021 Commonwealth Ombudsman report into Robodebt also made clear the marked differences from what had come before.

"The new approach allowed Services Australia to review all discrepancies identified through data matching since 2010-11, and differed from the old approach in the following significant ways," the report said (pages 10-11).

The report then listed several new processes adopted by the Robodebt program including the introduction of automation, the shift in responsibility being on the individual and Services Australia relying on averaged ATO income where the customer did not provide information.

The Verdict

The claim that Bill Shorten set up Robodebt under the previous Labor government is misleading.

While it is true to say Labor's 2011 data matching system was a precursor, experts told AAP FactCheck there were stark differences between the two programs and the main components of Robodebt - notably increased automation and the use of an income averaging process - were introduced by the coalition.

Misleading – The claim is accurate in parts but information has also been presented incorrectly, out of context or omitted.

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Twitter and Instagram.